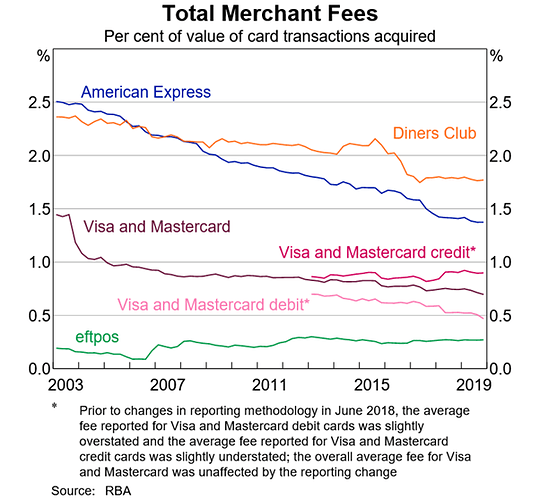

About 4% was the stated figure a year or so ago, and many businesses added this 4% into prices regardless of whether a payment scheme was used or not. So a Customer pays for the use of these schemes whether they use them or not. Some Businesses also add a further defraying charge for the use of a scheme…go figure double dipping as it is so obscure if the original price had been increased to defray already.

Chemwarehouse is offering $5 to download and register Fupay. It has to be big dollars added on or bundled in considering the numbers of payment companies springing up and the incentives to use them.

It appears to be a buy now pay later line of credit

Buy Now Pay Later everyday essentials like food, rent, cash or bills with our NEW Fupay feature.

It is possible that companies get commission for purchases through the platform… from the interest charged to those which have difficulties paying later. It appears also Fupay

‘simply charge a flat-rate fee of 5% on any amount that you wish to Fupay.’

and

‘In order to set up your Fu Virtual Card, we charge a one-off set up fee of $5.00. If you are using our Fu Card or Fu Bills feature your fees and repayment structure may vary.’

This might be were the $5 comes from.

The point is that there seems a lot of money to be or getting skimmed off the top in one way or another, or there would not be such a plethora of participants. One might expect a consolidation but the dollars in play will remain the same, just be more concentrated on which pocket(s) they go into.

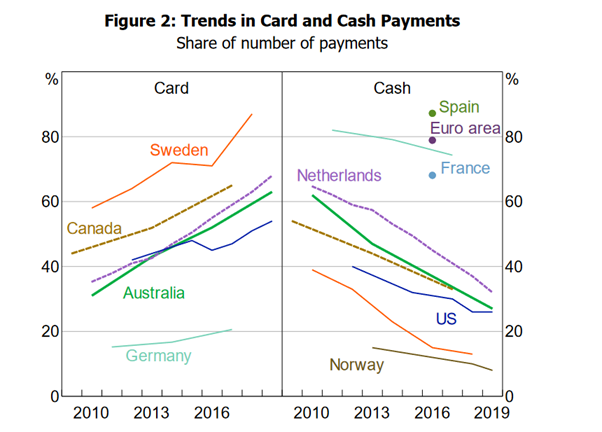

An article regarding the decline in using cash for payments.

Our local Woollies used to have 6 cash and card self service terminals but replaced 3 of them with card only terminals in the last few months.

They have now replaced another one leaving just 2 for customers wanting to use cash.

It does not auger well for cash transactions surviving.

I’ve commented on this before, but it’s just an ongoing social engineering plan to force people into a cashless society. There are other examples of this behaviour such as paying online, making life impossible without a ‘device’, or a credit card.

The thing I don’t understand is: when the internet is down for a long period of time, or a power failure that lasts for days, how will we manage? This, I believe will happen at some point and, as usual it will be a reactionary thing, with blame going in all directions. A bit like the “flood proof bridge” at Windsor in NSW.

I’ve been seriously considering withdrawing a largeish sum and keeping it somewhere safe in the house, just in case of such an eventuality. But if vendors arent accepting cash… they will have to rethink the whole deal.

Several of the Big banks in Melbourne offer Cardless Cash from an ATM,

a service useful in case of Internet

shut down ( Until the ATM runs out

of cash).

If we’re lucky, our Bank might still be able to operate with a ‘pen and paper’ system.

When there’s no alternative, vendors will take any form of payment legally available.

Advantageous to have a mixture of smaller value notes and coin? Change might be a precious commodity.

Is it a wise strategy to sleep on more than a few hundreds?

If you are worried about the cashless payment systems being down, then the same risks apply with withdrawing cash. Cash withdrawals use the same communication systems as that for cashless systems, so if one is down, all is down. Experience and history has shown that the system is robust and there have only been temporary outages (which sometimes are caused by human error or inadequate beta testing or upgrades).

A power outage is more of a risk irrespective of the payment system used (cash or cashless) as this will disrupt purchases at the point of sale as almost all retail point of sale systems run on electricity and have limited backup power systems. I have had experiences in both Coles and Woolworths in Brisbane during storms where power went off and point of systems failed to operate…meaning one had to leave trolleys/purchases and exit the store.

Oh of course. Wont bother then ![]()

There’s little incentive to keep it in the bank with interest rates the way they are - though it seems to me the best rate available at the moment is by proxy as an offset to ones mortgage.

Keeping cash at home can be useful if not problematic if one ever has to explain it’s origin - I’d recommend keeping an audit trail of withdrawals/etc with the cash if storing large amounts. My personal choice for storage is a combination lock container that is heavy enough to be immovable when not bolted down, then bolting it to the concrete slab.

Another option might be a safety deposit box, though these seem to be rare these days.

My experience here, twice, was that the PoS terminals lasted zero seconds from power fail ![]()

Personal experience varies depending on where one lives. YMMV.

Restoration of power can take days to weeks after cyclones, floods or bushfire. Locally for no reason other than a storm just a day or two. Resilience is still to be found in rural Australia.

P.S.

I think @SueW was suggesting having a stash set aside in advance, just in case.

Things can and do go wrong with electronic systems, and cards themselves can fail in readers.

I always have a small ‘stash’ of cash in my wallet. Small denomination notes and some coins. Maybe a few hundred dollars worth.

On a number of occasions recently shops have been very appreciative that I could pay in cash when their POS systems were not working.

To keep my stash topped up, I just ask for some cash out next supermarket visit. I haven’t used an ATM for about five years.

Correct me if I’m wrong:

an ATM uses the Bank’s own private network and it’s not subject to the Internet?

The banks, like almost all businesses, use the network infrastructure provided by Telcos like Telstra. These are the physical wires or wireless technologies that provide the connections between computers.

The ‘internet’ is a set of software protocols and applications that operate using these links.

In the case of ATMs, if the physical link is down, or if the particular software client server application fails (not internet, although some low level protocols may be used like TCP), then they can operate in offline mode for dispensing of money subject to withdraw limits.

I think we’ll go round and round with this. At the end of the day, I don’t put all of my eggs into one basket, to coin (pun intended) a phrase. I keep a reasonable amout of cash handy, at any one time. It’s enough for Liz and me, but may be pocket money for others, depends on the circumstances.

Finally, on the same subject, a work colleague of mine went to a service station recently and filled up with petrol. He only had his credit card. The system was ‘down’, and the cashier said he could pay with cash, of which he had none. The debacle went on for a long time, with requests for other security such as driver’s licence (no), medicare card, again “no”. Being local, it eventually solved itself the next day. Ho hum…what complicated lives we lead.

Recently, I looked for my card to pay at the supermarket’s self-service check-out and realised I didn’t have it with me.

I keep some emergency cash in my phone case, it’s tightly folded and been there a long time, and the machine kept refusing it. For a while it looked like I would have had to abandon my shopping, until an assistant came up and after I explained what was happening, kindly changed the note for me.

Meanwhile, some other people are apparently were getting well prepared for any EFTPOS or ATM dramas.