My experiences with virgin have been poor, the flights I have been on have all been delayed

This new topic is for visibility. Crosslinking to

Very disappointing if this is accurate. The damage to the population of having an airline virtual monopoly far outweighs the costs of a government loan or investment imo. Especially when Qantas/Jetstar have such a greaaat record of fairness to customers.

Fact, news at 9pm Monday night.

It will not be long before we find out more.

It may not end happily. Although none of us can see what else is being discussed behind the scenes. Hopefully the move is pre-emptive.

Waiting for the price gouging to occur with one less competitor in the aviation industry. Goodbye to all the cheap fares, especially as Tigerair is most likely a casualty too.

It’s been happening for years in places where there there already is only one viable option - barely viable in price - regional and remote - but I take your point.

It has been rather amusing for a long time now that QLD and NT are two of the foremost places to suffer from ruthless pricing from QaNTas … (WA also, not forgetting …). Now the rest of Australia, sadly, seem likely to experience the same …

Virgin was asking the Australian Government for a loan and was willing to offer up equity in return.

The loan was refused in preference to letting the market work it out. It could have been a very cheap way to have a significant interest in an airline and maintain competition.

Perhaps overseas interests will buy it up cheap and then ignore what is best for Australia?

The real question is then why is Richard Branson not supporting his airline but rather ploughing money into the Virgin Galactic Explorer (or whatever it is called) which is targeting the mega-rich to get a space experience.

This highlights mixed priorities are at play.

10,000 jobs on the line.

Six months or more on job seeker payments for many.

An industry that will be slow to bounce back and will have excess capacity domestically and international for some time.

A prospect there may only be enough demand to part fill the capacity of one airline well into our future.

The sting in the tail of the governments decision not to provide further support Virgin. What if in 12 months time Qantas is only back to part service and puts it’s hand out? With no competition it seems an unlikely scenario. What cost an airfare then?

Note:

What happened around the formation of the government owned airline TAA in 1946, including a High Court challenge to it’s establishment?

I remember the days of TAA and Ansett. Airlines seem to come and go.

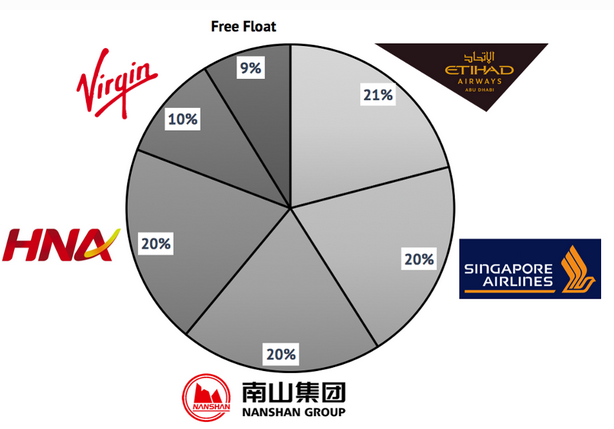

Just for perspective, it was owned by overseas interests already. I cannot help but use a pretty picture because it really makes the point. (It is also a hot link to its source.)

Why would a government bail out what is essentially a completely foreign owned private enterprise? If QF were in the same predicament the ownership is weighted domestically although with significant foreign interests but government could reasonably step in.

It would be like GM if they did. They would take the money and run, until next time when they again would expect assistance. Instead of a bailout the government could give each of those 10,000 workers $150~200,000 each and be done with it. QF would employ some of them, and capitalism being what it is, another carrier would eventuate.

I think it isn’t in the long term interests of the taxpayer as foreign owner will make the decisions of the airline. It could become another Ford or Holden where the government provides subsidies only for the foreign companies to take the money and then do a runner shortly afterwards.

It appears that a takeover by private equity after debt discharge is a likely outcome. This may still occur in a year or two even if the government coughs up the $1.4B, meaning the taxpayer loses their money… this is because Virgin hasn’t proven to be profitable and has amassed significant debt relative to its business size.

According to the latest article from the ABC, the Virgin board is to meet today to decide on its future.

So we have an airline which is over 90% foriegn owned but none of the shareholders, including Branson, actually want to put their money where their mouths are, and instead wanting the Australian Government to pay for their years of mis-management.

There was a suggestion in an article the other day that Singapore Airlines could be a possible buyer which may have a lot of merit.

There was also a suggestion that Air New Zealand could also be a possible buyer but after the disaster they turned Ansett into before simply washing their hands of the mess, Virgin would need them like Custer needed more Indians at the Little Big Horn.

Virgin is now officially in administration.

Branson criticises the Federal Government whilst failing to put his own money where his mouth is.

Branson has offered his island as collateral and claims his net worth is in companies that are all on their knees now. eg not lots of cash in hand.

is reported as having enough of its own cash flow problems to throw cash into VA. I could conceive that if there is a fire sale for VA SQ might be a bidder to ‘buy low’ and thus have the best chance at recouping it losses to date. Same for Emirates and the Chinese companies. If I had to punt I think a Chinese bid would be most likely since they seem more strategic in such things.

Is also essentially shut down with attendant cash flow problems.

I doubt any airline is in condition to buy much of anything with their fleets grounded and no pax flying. Anything in the air is going to be dominated by freighters.

You have done the sums, however out of pocket it costs less for

Not that the government might be thinking the same?

It might also need a change next time around in how the Federal Govt and each State Govt choose to continue to regulate air transport. The skies are not truely open. Qantas has long resisted international carriers flying domestic routes. Although Australia is not the only nation with that mindset.

Qantas is only where it is today, post WW2 because of government intervention. It started with the take over of Qantas in Queensland in 1946. Has there ever been a level playing field? If Capitalism had it’s way in 1946 Australia might have only one airline, and likely not QANTAS.

From the ABC news this moring, they indicated that the collateral would be well short of what is required to keep the Virgin group or any of its subsideries going. There are reports that the island is worth about £80 million (AUD126 million) and it would only be mortgaged (meaning that the collateral would be far less than the islands worth). The group needs far more than what his collateral would be from the island.

Virgin Australia needs around $1.4B (£710 million) alone, and reports are that Virgin Atlantic is is a similar financial situation.

I take it as mostly symbolic and more than many billionaires would do. As it notes, most or all of Branson’s companies are currently doing it hard or worse.

In comparison how many would just let the administrators do their thing and walk?

While the Velocity Frequent Flyer program is a separate company not subject to voluntary administration, they have paused redemptions under the program. This is posted on the Velocity website…

Date of publish: 21 April 2020

We’re committed to keeping our members updated throughout these uncertain times of coronavirus and reduced travel.

We wanted to share some information regarding temporary changes to the Velocity program and what this means for our members.

You may be aware that some of the Virgin Australia Group companies have entered Voluntary Administration. Deloitte has been appointed as the administrators, meaning they have assumed responsibility for the business and operations of those companies in administration.

The intention of the administrators is to bring the relevant Virgin Australia Group companies out of administration as quickly as possible and return to normal operations.

Although Velocity is owned by the Virgin Australia Group, it is a separate company and it is not in administration. That means we’re still operating, but we’ve made some temporary program changes in the interests of members.

We’ve made the difficult decision to pause all redemptions for an initial period of four weeks, effective immediately. This means our members won’t be able to redeem their Points for rewards during the pause.

We know how much our members love to plan their travel and use their Points to redeem flights, however the ongoing travel restrictions and reduced flights have limited the options for them to use Points for flights. We’re seeing more members use Points to shop online for items such as gift cards, electronic goods, and wine. This unexpected demand has made it difficult for our suppliers to provide these offers and limits the availability for all members to redeem their Points.

What our members need to know:

· Your Points aren’t going anywhere. They will remain in your account.

· Your existing Points will not expire through this period. We will be extending the expiration period for your existing Points by the timeframe of the pause.

· You can continue to earn Points with our partners, although you won’t be able to redeem them during the pause.

· These changes take effect immediately. Although the initial timeframe for this restriction is four weeks, this period may be extended. We will come back to you with an update as soon as we can.

What’s next?

Velocity has a trustee in place to look after the interests of members. We will continue to assess a range of options for the program and we want that to include a continuation of our long-standing partnership with Virgin Australia.

We thank you for your patience, loyalty and understanding in these challenging times.

The Velocity Frequent Flyer team

We have a redemption being processed (redeemed last week) and I wonder if this will also be paused as well…or they will continue to process any outstanding ones they have?

Does anyone have any idea what it means for VA codeshare flights with other airlines. Are they/ will they be cancelled? All very confusing!

Thanks team

Another article regarding the Virgin collapse.

The statement that Australia cannot support 2 airlines may be correct.

The article states “Australian aviation is littered with the names of airline hopefuls that became casualties: Impulse, East West, Compass, Ozjet and, of course, Ansett. That’s just in the past 20 years” but that overlooks the fact that there were actually 2 Compass airlines and excluded Tiger Air so a total of 7 failures in 20 years.

It would be either be a very brave or a very foolish investor who would be prepared to be #8.

An article regarding Velocity rewards points.

Our son-in-law cashed in all their Velocity points for several thousand dollars of Woollies gift cards a while back. He will obviously be breathing a sigh of relief.