The links I included a few posts above show the merchant fees for both Visa and Mastercard.

My understanding is these are the standard fees and the interchange and merchant fees can be negotiated down, especially if one has a high volume/sales value.

Agreed, but much of that appears to be captured in the rack rate fees as published. A small merchant might negotiate the deal Coles gets even with lesser turnover, but that is beside the point, as I understand the point.

Just purchased an airline approved pet container online from My Pet Warehouse so that my wife can bring our new puppy home with her and I selected PayPal as the payment method.

Of course, the payment was declined as CBA cancelled my Amex card that they had only just renewed in June. I did not even bother with the new Amex card which will be cancelled on 01.11.2018 so I updated my PayPal account with the new MasterCard.

Thanks once again for nothing CBA. The gift that keeps on giving.

CBA is not Westpac, but Westpac advertised the cancellation of their companion Amex cards about 6 months ahead, with increasing frequency of reminders as the date got closer. Didn’t CBA do likewise?

Not that I am aware of. The first notice that I recall was the letter that the latest cards were attached to.

But I am not complaining about them dropping Amex. I am just annoyed that they chose to cancel our existing cards, especially when the new Amex cards we only just received in June could have been simply cancelled on 01.11.2018.

So, I have updated our mobile phones and now PayPal twice in 2 months.

With fiends like them, who needs enemies?

I find the emoticons on this website are too small for me to clearly view so I Googled “emoticons” and one of the results was Facebook Emoticons which are much larger and easier to view.

At last I have found a worthwhile use for Facebook.

I suspect that after the past week, Mark Zuckerberg may well be using this one.

I got a shiny new 4K monitor to view photographs but found some text and other material was too small depending of the app that was rendering the screen. I found that by juggling the magnification of the Windows display settings and the page zoom and font size of my browser I could compensate quite well, using more pixels per character or icon to make them readable but using the full resolution for images.

One can also paste a emoticon image as well which can make it as big as one’s heart content…

I have also noticed them being small have have done what @syncretic suggests from time to time when hard to see.

Thanks for your help. I tried it out.

I always feel that a day when one does not learn anything is a day wasted.

Just received the email copied below from CBA

It is obviously worded to try to create an impression that it is something they have voluntarily done to “look after” their customers whilst in reality they are only complying with Government legislative changes, whether they like it or not.

But hey, never let the truth get in the way of a good story.

"Dear,

We want to update you on the changes we are making to how we report your credit information to credit reporting bodies and the impact this may have on your credit report. Your credit report is what helps determine your suitability for credit products such as a Home Loan, Credit Card, Personal Loan or Personal Overdraft.

Comprehensive Credit Reporting (CCR), also known as positive credit reporting, is happening across a number of financial institutions in Australia.

What this change means for you

Today your credit history may include information such as when you applied for credit products, as well as any significantly overdue accounts or defaults you have had in the past.

The change means your credit report could include additional information, such as the date you opened your credit account, the type of account opened, the credit limits you have and up to 24 months of repayment history.

As always, protection of your data and privacy is very important to us. Please refer to our Privacy Policy for more information on how we collect, share and use your data.

How this change may help you

Over time, your credit report will provide a more accurate assessment of how you manage credit. In turn, this helps us to continue to meet your needs whilst lending responsibly and ultimately helping you to secure your financial wellbeing.

How to get ready for Comprehensive Credit Reporting

• We recommend you make your repayments on time – this is more important than ever as it will appear favourably on your credit report.

• Consider setting up direct debit (such as AutoPay for credit cards) to avoid missing a payment.

Please visit CommBank for more information on CCR, what it means for you, how to obtain your credit report and what to do if you are having difficulty making payments or are currently receiving financial assistance from us. You can also read about credit reporting more broadly at CreditSmart, Australia’s Retail Credit Association website.

Yours sincerely,

Angus Sullivan

Group Executive Retail Banking Services

Commonwealth Bank of Australia ABN 48 123 123 124. Australian credit licence 234945.

Privacy Policy

This email was sent from an address that cannot accept incoming email. To contact us, please visit the Contact Us section of our website."

I got the same letter. Very inconvenient having to change all direct debits for no good reason. If I have to change … may as well use my ME credit card from now on. Tired of being pushed around! Plan to also refinance my last two investment loans away from CBA when they come off fixed rates in October. I know my little hissy fit won’t really hurt the big bank, but just imagine the impact if we all voted with our feet more? Ciao CBA.

I just logged onto the Commbank website and saw this displayed.

“Hi XXXX. You last logged in 2/12/2021 at 04:06 PM (Syd/Melb time).”

I wasn’t aware Australia had adopted the US date display system.

![]()

I just paid the latest CBA MasterCard statement which clearly showed the total owing of $1,925.07 but when I clicked online for the details, it showed “Last statement total owing 06/04/202, $1,866.58”, and when I went to do the transfer, it listed a choice of total owing of $1,866.58, minimum payment of $70.00. or “other amount”.

As I would not trust them half as far as I could throw them after the disgusting 2005 incident, I paid the statement amount of $1,925.07.

For some months now, the online details have shown the total as a lower amount that the statement total but this is the first time that I have had to do the other amount nonsense.

I suppose at least they do not charge for the monthly SMS payment reminder. At least not yst.

![]()

The difference in the amount between the statement and the online indicates that you deposited $58.49 into the credit card since the statement was printed. Have a look on-line and you should see a minus amount(s).

CBA give you the option of paying the statement amount in full, or minimum or whatever you want. The $58.49 would be charges arising after the statement date.

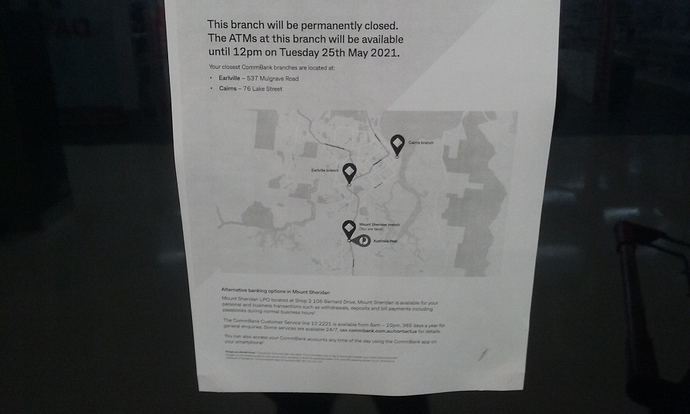

The CBA branch in the Mt Sheridan Plaza shopping centre has been closed since early last year due to social distancing.

However, when I walked past today, I saw a notice stating that the branch is now permanently closed and the ATM’s will be removed from service as of 25.05.2021, a mere 20 days time.

As well as dispensing $20 and $50 notes, some machines accept coins, notes and cheques and dispense change.

Many local traders use them to deposit their takings and to get their change.

CBA has not even had the common courtesy to place a notice on their website advising of the closure.

https://www.commbank.com.au/personal/locate-us/qld/mount-sheridan/064797.html

The nearest CBA ATM’s are at Stockland Earlville, some 6km North, and Piccones Shopping Village Edmonton, some 5km South.

The nearest CBA Branch to the South is Innisfail, some 79km away.

The Mt Sheridan LPO is only open from 9:00 AM to 5:00 PM, Monday to Friday and from 9:00 AM to 12:00 on Saturdays, and does not have any ATM’s.

The CBA announced a profit of almost $4 billion for the first half of this financial year.

You have to love this bit of hypocrisy at the top of the report.

" CBA’s 1H21 result underpins ambition to build “tomorrow’s bank today” for customers"

What a disgusting bunch of greedy, bottom-feeding grubs.

![]()

The same has occured this month.

My latest statement is up to 14.04.2021 and lists the balance as $2,395.50.

Today when I logged in and clicked on “Account Info”, it has mysteriously changed to $2,386.50 despite to credits showing since 14.04.2021.

Which Bank?

![]()

Have you rung them to ask why? What was their reply?

The statement will be based on the balance when the statement is compiled. If you go to your account on a particular day, the balance will include payments, refunds and holds which have been assigned to the account since the statement date. This is where the difference may occur.

Have you tried reconciling your credit card statement and then your account against known transactions to see where the discrepancy lies.