It is definitely a request from the credit card company, but one that I do not feel inclined to answer. It seems that they are seeking to apply a law that was too broadly written for their own data collection purposes.

Reality is it is from a financial institution. Financial institutions do not often differentiate their data collection re FATCA and money laundering legislation by product because a customer may open another product where that data matters.

If you add a share trading facility for example, your occupation is required as part of that application these days as well as other bits that border on the nonsensical but serve to show the institutions diligence at understanding your circumstances and risk tolerance. (Oops, fell off my chair, ouch).

I have some US accounts that ask the same questions once a year as required by law. My Aussie accounts have only ever asked them once when I opened the account, until recent years when they were tasked to identify every customer who was or even might be a US person. That they asked shows they are trying and have covered themselves. Whether you answer or not is, for now, not their worry ![]() but expect them to periodically keep trying.

but expect them to periodically keep trying.

Maybe not a scam but maybe info they failed to collect in the past. With the RC, they may be doing audits to ensure that there data has been captured and current. Also see…

Check the cards T&Cs about what information is recorded and what is maintained/updated for currency. Also check current applications by the same card provider to see if this information is required for a new credit card application.

I suppose the worst they can do by refusing to provide the information is to cancel the credit card(s).

I received the same email and wondered… I think I’ll take up the suggestion to ring the credit card provider and talk to somebody. If the requirement is ‘real’, I would have preferred a an option to ‘reply’ with the information they want instead of having to go through such a convulated procedure — I’m 78 yrs old and have better things to do with my time!

I had the same request from one of my credit card providers (Coles Financial Services) and was concerned about the contained threat to deny me credit if I didn’t comply. As usual their website was utterly useless when I tried to update the required information (and I agree: what is the relevance of my nationality and occupation?!). I phoned them to provide the details but they didn’t seem all that bothered so I was left feeling that the whole exercise was just that: ticking boxes because someone somewhere decided they needed ticking…

FATCA and the long arm of US law such as the Financial Crimes Enforcement Network. Everyone should realise neither ‘foreign’ law nor international boundaries are of interest to the USA when it suits.

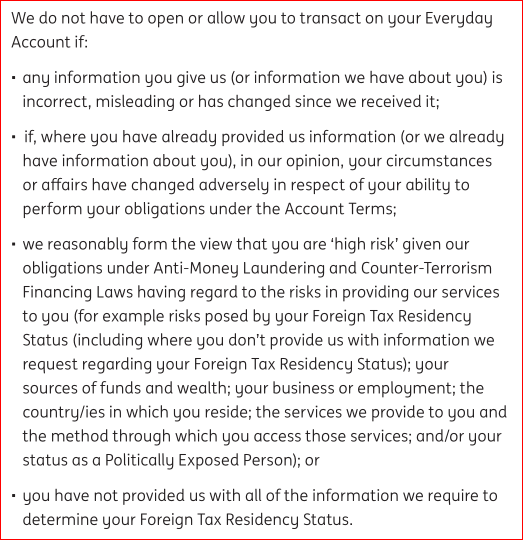

From ING today! A change in their T&C that is germane. Everyone can expect all the financial institutions to do something similar if not ‘today’, ‘tomorrow’. Bottom line is they can freeze the account for non-compliance to provide the information they require for their own compliance.

In other words you don’t have to have done anything wrong, but if for some reason one of our staff members deems that you may have possibly not done what we want, we will treat you as if you were guilty and you will suffer the consequences.

Should any consumer be surprised by this action?

Our own governments have demonstarted EG TPP, a desire to apply US media and copyright laws, while allowing marketing discrimination and differential premium pricing for OS supplied products. Nothing new here either?

Although I have not received any such requests, yet, I don’t recollect being asked in the past to provide details of residency status or place of birth for financial documents.

Is there still logic as to why some old timers still believe in cash only (and the pillow bank), while the young believe only in credit?

Since you mention this, 2019 is the first time since 1998 that US copyright laws allowed items into the public domain. Thanks Sonny Bono and Mickey Mouse - and thanks to successive Australian governments for wanting to keep up with the Joneses (er, US and EU).

In Australia, nothing published by an author who died in 1955 or later will enter the public domain until 2026!

Hilariously, these crazy extensions of copyright are from a country whose constitution provides that its Congress has the power:

To promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries.

Somehow that does not seem to me to align with copyright/patents that go on long after the creators have died.

Back on topic, I have so far failed to provide the requested information to my financial institution and it continues to provide me with credit card services. Can’t have been too important.

Time will tell as the long arm of US law and the wet noodle response of AU law wobble along in tandem. FWIW ‘Tax residency’ is mostly a euphemism for ‘US Person’ but a few countries have found signing up necessary to protect their own banks that operate in the US, as well as aiding their own money laundering oversights. Credit cards are suspected of being used for money laundering, so do not think they will be exempt. It is just when.

You are absolutely correct. I did copyright law as part of my music qualifications at uni, and my whole class thought it was crazy despite the fact we were the supposed beneficiaries.

Yep the Credit Card doesn’t even need to be used for Credit, just load the card with excess funds and dip into those, no interest ever charged, no repayments and the card is still usable wherever it’s type is accepted…the outcome of this was the rise of the Visa Debit Card which uses your own Debit account funds to use as a credit facility.