Created this topic to allow discussion of some of the more difficult to understand why it isn’t seen to be working issues.

Too many people looking big increases in pensions. The pension was only ever supposed to pay for basics. I have no problem living within my means even with the recent increases for everything (wow meat is a shocker). I have bought takeaways possibly 10 times in the last 30 years. I never buy coffee out and only once bought bottled water. I use my car sparingly, hence it is six years old and has only done 28,000 kms. My rent is the same as public housing and that is one area that some people will have trouble, if they are paying private rent and more so if they are single. Too many pensioners seem to think their pension should be paying for holiday cruises etc ( which many can actually manage if they are are frugal). I agree with comments from others that because we did it rough when we were younger we can adapt more easily. I am looking at a multi cooker (Slow cooker - pressure cooker) as I got rid of my pressure cooker a few years ago. Think I’ll be needing it for cheaper cuts of meat because unlike fruit and veg the price is unlikely to go down again.

Fixed income does not equal “pension”, it means that there are no ways of increasing the income such as it may be… no longer hours, no wage increases, no hope of the Govt increasing the old age pension rate etc.

Inflation is a killer for those on fixed incomes as price rise but income doesn’t!

IMHO (In My Humble Opinion) raising interest rates would have to be the dumbest most stupid way to curb inflation.

All it does is make the rich richer to disgustingly wealthy, helps some retires, and crucifies the middle and lower class.

Our gas and coal used, and the government should set the price they can charge.

I could add a lot to this, but will keep post on track.

Unfortunately not doing can cause hyperinflation. Turkey recently experimented with ignoring interest rate rises to curb inflation, and is a good example of why it is done…

I am amazed that there seems to be reports that 60% inflation in Turkey is somewhat good compared to the <80% in past years. I couldn’t imagine living somewhere where prices have doubled in just over a year.

I am also unsure why you think the rich get richer from interest rate rises. Inflation erodes their wealth and as saving interest rates are usually less than inflation, assets were stored as cash be going backwards relative to inflation. The rich who don’t have high levels of leverage may be better placed to weather high interest rates. Those highly leveraged may have sleepless nights.

So what is the best way to do it?

No, idea, as I am technical junkie, not an economist junkie.

Screwing and causing pain to the middle and lower class in particular goes against all the principles of humanity.

Thing is I do know we were the only country dumb enough to bring in negative gearing and all the issues it has created.

Sadly Australia grows more like the good ole’ US of A daily in all the wrong ways.

It seems the economists don’t know either. So do we use the one lever that works to some degree or do nothing and just let inflation rip? I suspect letting it rip would be worse as that affects everybody not just those who borrowed the max and now feel the strain.

Of course those maximum borrowers were told that sooner or later interest rates would rise but they decided to try their luck anyway and added in some extra rooms and an outdoor dining area to their McMansion. Compared to similar rich countries, despite silly land prices and ballooning building costs, we build very large houses.

Now you are coming to grips with the heart of the problem. It isn’t the mechanism of inflation control that in itself causes the problems it is our dysfunctional real estate market that so favours the investor over the occupier, the capital owner over the wages worker and the old over the young.

Our fearless leaders have know all about this for decades and while they wring their hands and promote first home buyer supplements (that actually make the problem worse) they are careful to never actually do anything to solve the problem. They are afraid of the backlash at the ballot box if those who have money in real estate do not get a nice big capital gain year after year. This sets up huge inter-generational inequity in assets - especially when the family home is exempted from consideration.

You’re making an interesting statement…but…

Then: how did you come to the conclusion that raising interest rates to curb inflation…is the most stupid way….?

There have been many looking in the rear view mirror including self reflection by the RBA’s own admissions. The impacts are not equal across socio economic groups or for different sectors of the economy.

The Government response to Covid included incentivising the draw down on savings and pumping up the home building and construction sector. It’s a contributing factor to the current economic outlook and prospects of down turn.

‘Deloitte Access Economics Business Outlook: Australians at the Reserve Bank’s mercy in 2023 | Deloitte Australia | Deloitte Access Economics, Media Release

Easily, because it penalises the people with single homes and families. I don’t give a stuff about investors in any way.

You seem oblivious to the tax laws and practices of the USA, obvious and not so obvious. They make ours look like they were created and written by novices to the game.

I don’t think many here would disagree that raising interest rates is a crude instrument that has nasty side effects.

Insisting that it is most stupid when there is no other option that it is more stupid than is not useful. Talking about what might be done instead to prevent the worst of the side effects of the only weapon we seem to have will be more constructive.

We can all find a long laundry list of things wrong with Oz very easily. Getting it off your chest (a time-honoured tradition here) is OK but if you really want action more is required.

That’s being oblivious also to those on a fixed income who are far from being rich investors.

Why are interest rate changes and tax changes intractable problems?

All very simple to my understanding. The former is monetary policy, and the later fiscal policy. The former managed by the central bank, and the latter by the Gov.

Well that explains everything I have ever wanted to know.

Do you have any thoughts about the unintended consequences of interest rate control? What about who should pay tax, how much and the best mechanism? Are these all so simple questions too?

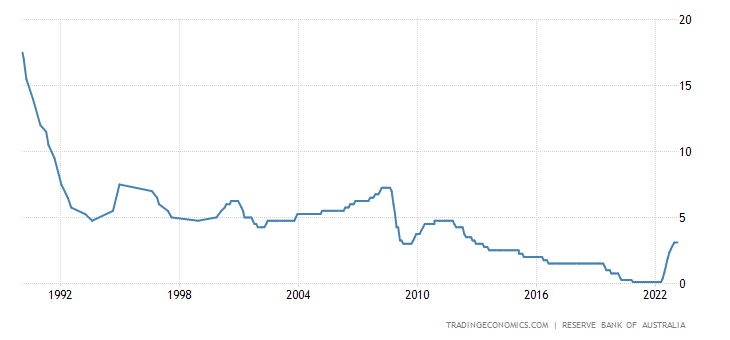

An interesting graph of typical mortage rates. Didn’t hear me whinging and whining like a worn out holden EH diff when I got my first home loans in the 1990s.

Rates are just returning to a normal setting to match CPI and GDP growth. But you probably don’t want more economics. Enough for today.

I would love to have more economics but a graph showing interest rates over time is not explaining the unintended consequences of interest rate control is it?

If some borrowers having to adjust and pay a more normal rate of interest than the artificially low interest rate they have got in the last few years is considered an ‘unintended consequence’, then so be it. That is what the graph shows.

The central bank has much bigger fish to fry. Namely trying to dealing with inflation. And that means controls on demand for money.

It could be viewed as using a sledge hammer to crack a walnut, but what is the alternative?

Broad price controls by Government? Not likely unless if we want a Socialist command economy.