My House and Contents insurance is due for renewal. The premium increase was unreasonable so I started to get quotes using exactly the same figures. The quotes ranged from $850-$1500, the highest figure being from my current insurer. I settled on a target figure of $1200 and

rang a major insurer whose advertising tells me I would be ‘lucky’ to be with them.

We discussed my needs and how the sums to be insured had been calculated, the representative quoted me $1400 for the cover I required. When I said I was looking to pay $1200 I was told this could be achieved by reducing the sum insured. As we had already agreed on the appropriate sums to be insured, I felt I was I was being encouraged to underinsure. I declined and went elsewhere.

Is this a common experience?

Not as common as the broker deliberately selling a policy that won’t cover you when you most need cover, without telling you that that’s what they’re doing.

Here’s relevant page that I found, following a link elsewhere in this forum:

http://david.boxall.id.au/Insurance.html

Our experience has always been the opposite.

We have both our house and contents and our comprehensive car insurance with Suncorp but whenever I have got online quotes for the same insured sums from CommInsure, RACQ, APIA and others, they have always been dearer.

My wife’s late parents were with APIA and when I got online quotes for their home, Suncorp, CommInsure and RACQ were all dearer.

It almost seemed like they were linked in some sort of cartel.

You are right to not underinsure, as if you were to have a major claim, the insurer can classify you as co-insured and pro-rata your settlement accordingly.

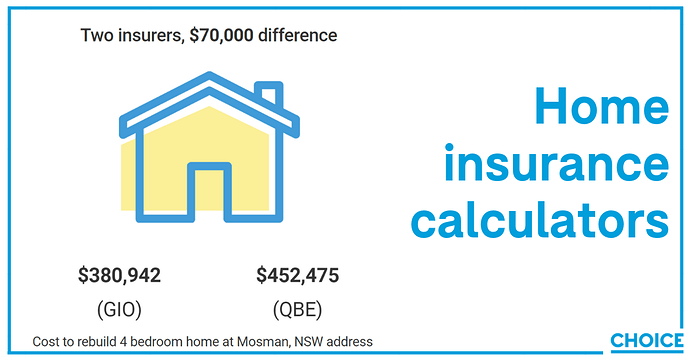

@andrew.p, we’ve heard from a number of consumers about a range of problems around underinsurance. We’ve also found that online calculators can provide wild variations in their estimates.

Thanks for sharing your experience, look forward to hearing from other Community members on the issue.

Another slight of hand could be AAMI’s ‘Complete Replacement Cover’ option. It sounds good but the PDS clearly indicates AAMI holds the aces.

’AAMI Complete Replacement’ might be the first nomination for a 2019 Shonky.

From the PDS (bold added)

AAMI Home Building Insurance with the Complete Replacement Cover ® option covers insured damage or loss to your home building for the total amount it would cost us to repair or rebuild it. When you have selected the Complete Replacement Cover ® option, we repair or rebuild insured damage or loss to your home or pay the cost of repairing or rebuilding to the same size and standard of your current home.

Some exclusions apply. Please read this Product Disclosure Statement for full details.

Our Complete Replacement Cover ® option is your best protection against underinsurance.

Using @BrendanMays example, I wonder if that payout would be nearer (eg under) to $380K rather than $452K and if AAMI would guarantee a builder would actually repair the house to a high standard of work and materials for the amount offered, not just provide a low quote for process and procedure.

Not much has changed and they are still at it, excepting AAMI are now up front about what they will pay while keeping their weasel words intact.

The outcome, transparency that ‘Complete Replacement’ is nothing but a marketing gimmick. Note the registered mark -> Complete Replacement Cover ®

There can be a considerable variation in construction details, finishes etc between properties of similar size. From insuring a number of different styles of property over time, the staff or forms required to obtain quotes have never picked up what others might consider substantial differences to the cost of replacement. Subsequently we’ve always insured for an agreed value, that may or may not be a reliable estimate. I’ve noted the link per @BrendanMays to the Choice guide to consider how far out we may now be.

Although we also need to consider if it is practical or affordable to rebuild a house in the same way as the existing 1880’s vintage with similar materials and fittings and meet current BAL ratings? Using modern materials, with a simplified style for an extension we quickly hit $2,500 /sqm. No doubt this is not uncommon and a difficult decision between providing for an adequate replacement vs the irreplaceable.

I believe that covers you to a max amount for a total loss; they will not pay more than the amount of loss you can establish. Not making light, but you can insure a Brighton beach house for $1 million but if it burns to the ground they will only pay rebuilding costs, up to the $1 million. If it costs $100,000 to rebuild that is what you will get, but if you only insure it for $50,000, that is what you will get.

Now with vehicles, agreed value is the way to go because ‘market value’ can be anything from what a dealer will give you cash for your vehicle in pre-accident condition, to the private sale market average over a recent time. It can be much less than one thinks their vehicle is worth. It also affects when they will repair vs write off as that amount is the ‘trigger’ point to write it off. Collector and rarer cars are especially problematic since there is often little to no ready market value so it can be a serious ‘discussion’ as to the market value. Your original GTHO Falcon can be seen as a 40 year old car rather than a $1 million classic on the first pass…

I rather like this perspective, from the link I quoted above:

Insurance has much in common with gambling:

- Both have had centuries to figure out how to stack the odds;

- In both, the odds are stacked against the punter and

- Both exploit risk pathology (one addiction, the other aversion).

Perhaps the most substantial difference is that gambling has well known rules which all participants are in a position to understand.

… and gambling sometimes involves gangsters and organised crime, but that is still significantly better than involving lawyers ![]()

There’s a line from some film or other in which one of the characters comments that a man with a briefcase can steal more than one with a gun.

I would suggest that you get a valuation for the home from a certified valuer (not from a real estate agent!). Then you will know what sum to insure for, and you can provide insurers the valuation to prove what the home is worth. Then you will need to do due diligence to get the deal that suits you best. Make sure that clearing and rebuilding costs, storage costs, and alternative accommodation etc., etc., are all included in the policy.

The following year, ensure that you have allowed for the appropriate (usually) increases in values and costs before renewing.

Walk lightly and carry a large briefcase? ![]()

Very good advice! It is incredible how a lot of people aren’t even aware these people exist - but then how many aren’t prepared to pay a few hundred to know the real value! “but the real estate agent will do it for free” … I remember the old chestnut “free advice is worth every cent”.

So the vested interest for the certified valuer is your payment of a few hundred and maybe your referral has a happy customer …

The vested interest for the real estate agent is they want the job of selling your house - and as has been covered before, if when they sell your home they miss their valuation by 50k it only makes a small dent in their commission, but they got the job, and the commission, possibly because of the wonderful valuation that they gave …

I’ve used a certified valuer a few times and it has been a very good investment in understanding where I stood, both when buying and selling.

And the huge benefit is that the insurers can’t argue that you are over/under insured when it comes to payout. Can make a HUGE $$ difference in what you receive.

However, the common amount specified is for a total not partial loss , so it remains a bit of a punt in dealing with the underwriters and their low ball contractors. How much to replace the burnt out roof over half the house? You say $150,000 they say $80,000 and give you the money as their full offer of settlement, remembering most policies give the underwriter the option to repair or give you their cost of repair.

A good valuer will ask the purpose you require the valuation for. The fee may vary accordingly. A property valuation for legal purposes is likely to be much more than a few hundred dollars, notably if it has a tax related outcome. In that instance it is typically the reasonable market value for the date of valuation for the property based on evidence of recent property sales and market in the immediate area for like sales.

A real estate agent will also try to provide the same advice. And yes it may if you are looking at selling not quite spot on. But then it costs nothing and you can talk to more than one to get valuations. These are unlikely to be reflective of the value or cost of replacing the dwelling and improvements. Agents and the markets discount sales for improvements, age and fashion. They have very limited knowledge of the cost of replacing a dwelling and improvements with allowances for site remediation, council costs, etc. That’s what a valuer come Quantity Surveyor is certified to do. If they are not certified don’t bother.

I’ve done it for both - with investment properties/etc - on shopping around I reckon I paid just south of $500 once, and paid in the 2-400$ a few times for various other purposes. As a lay-person, it’s difficult for me to define the veracity of each in comparison, but the 15-25 page report with pictures, details, research and described observation certainly beats the pants off a real estate valuation …

Have you heard of paying a lot more than that for formal valuations with tax implications? my areas were Adelaide Hills, Melbourne Hills (outlying) and outback Australia - this might have some impact on pricing I guess. If it was a 5 million dollar penthouse in the Sydney CBD then, well … I guess I’d expect to pay a bit more because … well because …

I’ve had to arrange it several times for multiple properties as part of property or estate settlements all in SE Qld. Each time we obtained quotes from at least three Registered/Certified Valuers. The small local blokes have always been the cheapest, in particular if they know the area well. Over the previous ten years the costs have varied between $350 and $800 all for sub $1M value residential or small rural lots. The valuations have been relevant to Capital Gains (ATO), State Govt transfer costs/Stamp Duty, and in several instances apportionment of funds in deceased estates. Note these reflect the whole of property value. The revaluation of a 5 pack of town houses using the same business as previously (excludes land and market issues) fees hit $1,500.

Having worked with Quantity Surveyors from the industry one of the major costs is the insurance cover they pay for protection against claims if the values are ever challenged at some time in the future. One of the smaller guys we used dropped out of the business for that very reason. It cost too much as an individual. No doubt if you insure a dwelling based on a professional valuation when it burns down you find out it will cost 50% more total out of pocket to replace, you might go looking for action in a court as you are entitled to.

Market value if you are buying or selling is not subject to the same risks. As the day of the sale is not the day of the valuation. Markets are not so absolute. However sell a deceased estate property for less than the value the inheritors expect, you may need a legally defensible value. It’s perhaps why so many deceased estates go to Auction as the valuation is then only a guide to what the market might offer.

in all of this it is typically the land value that is driving the final outcome. The dwelling is an optional accessory.

Many of the smaller operators and partnerships providing these services in our area SE Qld appear to be subject to a rationalisation as larger businesses buy them out? Fake growth of the larger business, but a great way to reduce competition and longer term improve profits.

You should always expect a detailed report with full descriptions and a proper supporting explanation of how the value was determined. 25 to more than 40 pages is typical.