The Quality of Advice Review is currently underway, seeking to ensure “that Australians have access to high quality, affordable and accessible financial advice”. However, a number of consumer advocacy organisations, including CHOICE, have raised concerns that the proposed changes will reduce consumer protections and open the door for conflicting or poor financial advice leading to significant loss and hardship.

CHOICE CEO @AlanKirkland had this to say on Twitter:

Let’s remember why the big banks all decided to get out of financial advice: when they had big advice businesses operating without strong consumer protection they ended up paying out millions of $$$ in compo for poor advice. Who’d want to go back there?

Are the proposed reforms opening the door for trouble? We welcome your views on the issue, add them to the thread below.

There is a lot of information to consider to here, but as mentioned in the above ABC article, here is a basic summary of the proposals:

Quality of Advice Review consultation proposals:

1.Regulation of personal advice

2.“General advice” should no longer be regulated

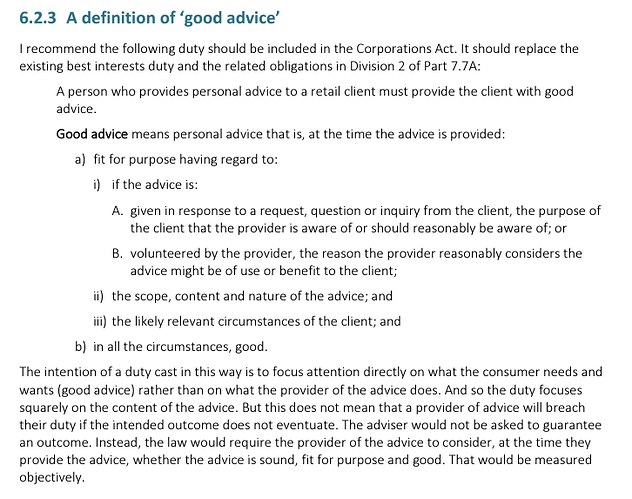

3.Obligation to provide “good advice”

4.Requirement to be a relevant provider

5.Personal advice to superannuation fund members

6.Superannuation funds to decide how to charge members for persona advice, allow collective charging

7.Allow super funds to pay a fee from member’s superannuation to an adviser

8.Scrap ongoing fee disclosure statements

9.Statement of advice to be maintained for retail clients

10.Make financial services guide available

11.Simplify reporting requirements

12.Allow adequate transition time, allow for providers to “opt in” early

The article goes on to mention:

Financial advisers or “relevant providers” who get paid a fee for service would still be required to meet existing professional, ethical and educational requirements.

However, people employed by product issuers such as super funds, banks or insurers, with only some training, would also be allowed to provide advice to customers.

CHOICE has specifically highlighted the following key points where action is needed:

- Ban all remaining conflicts of interest in the advice industry.

- Retain the best interests duty (this is in contrast to point three of the proposals).

- Consider alternative models to financial advice for people seeking guidance.

For a deeper dive, here’s some shortcuts to the Treasury’s Proposals Paper and CHOICE’s full submission paper (PDF) to begin. We look forward to hearing your thoughts and impressions on the issue.