Thanks mark, its a good forum

Was talking about the really bad reviews the Dux Aeroheat was getting & that mine lasted almost 14 yrs, l’ll be amazed if my new one does that ![]()

It’s always a challenge when there are now so many to choose from. They are really just a simplified air conditioner or refrigerator operating in a very simple mode. The waste heat goes to a water heat exchanger and the evaporator draws its energy from the air outside the home.

For those not aware and seeking some useful information on what to consider/reviews.

They only need to run for a few hours each day. Even our primitive by today’s designs Fujitsu split systems in North QLD ran for most of the day for more than half the year. 15 years and no problems. So the basic technology can prove very functional and reliable.

Like split system air conditioners some may be vulnerable to pests including geckos. Worth considering if they are prevalent around the home.

It’s difficult to relate current model reliability to those sold 5-10 years past. Brand reputation and current model reports of poor service/faults are all most can rely on.

An interesting view of the connection between inflation and energy policy from the SMH.

Second, we shouldn’t be using higher interest rates to respond to the surge in electricity and gas prices caused by the invasion of Ukraine.

Because of the way we’ve set up our energy markets, the increases in international prices came directly back into Australian prices. This put us in the paradoxical position of being the world’s biggest exporter of liquified natural gas and coal, taken together, but most Australians became poorer when gas and coal prices increased.

[Italics added]

The way the quotes are structured I am unsure if this is from Ross Garnaut or Ross Gittins, I think the first.

In any case they are both unconventional leftish economists who you should not listen to if you think the status quo about energy or inflation management is acceptable.

The ACCC regularly reports, as does the AER on the Australian electricity market. The latest review was current up to Q3 2022. It includes informed commentary on how the market performed (conditions), and regulatory responses to the higher than usual FF costs, demand increases and generation failures over the preceding 12 months.

It’s a long read and detailed with technical/commercial. The Executive Summary and Recommendations (first 6 pages only) may be the most productive read.

Of note were the actions of the AEMO to cap spot prices for a period of time, as well as make directions to the generators to ensure supply.

On Pricing -

Some of the electricity volume purchased by the retailers is contracted in advance at fixed prices. Additional needs are typically purchased through the regulated spot market. The risks of volatility in the spot market are most often managed through a third party and hedging contracts. For the average consumers this may not mean very much, but is very relevant in understanding.

It is not uncommon for the media to grab short sound bites, considering the spot prices are recontested in 5 minute blocks 12 times every hour. They can be relatively very high when demand peaks (typically in the evening) and fall to low, zero or negative prices in the middle of the day.

Neither extreme is truely reflective of the long term average. They ignore the averaging influence of the fixed supply contracts and hedging. More frequent and prolonged high spot prices are indicative of the trend towards higher costs for consumers, but not to the extreme of the spot prices used for headlines. It is fact that prices have gone up significantly, depending on where one resides.

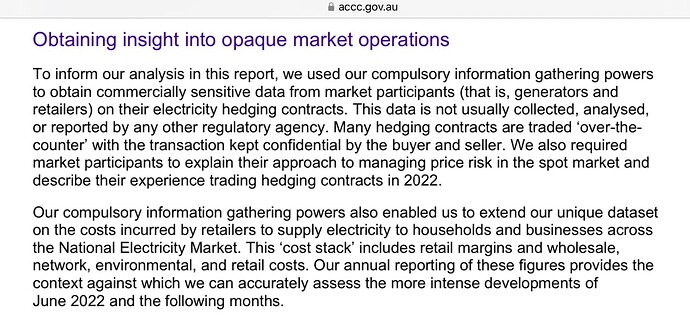

The ACCC moved to look closely at the hedging contracts and long term supply agreements entered into by the retailers for the wholesale market. The relevance is best explained by the ACCC.

The role of the ACCC and it’s appointed regulator AER is independent of government. Individual consumer outcomes for energy pricing are further influenced by differences in the approaches taken by each state or territory government. All have made decisions independent of each other on transitioning to renewables and the level of involvement/retention of assets in their respective markets.

While energy costs have taken off, detailed discussion may need to qualify which state or territory the circumstances or content relates to, and possibly which distribution area.

EG QLD regulates directly consumer tariffs where Ergon is the distributor, outside the SE corner of the state. It also retains ownership of the other distributor Energex and the transmission assets, as well as a significant generation capacity. Two different outcomes within the one state!

This announcement touches in several topics. The prospect is the purchasers see greater profit and income in return for their investment.

Is this a positive outcome, assuming the Minister and FIRB approve the sale to two unlisted foreign investors?

It’s worrisome that a foreign investor can see greater profit in an Australian based enterprise than our own cashed up super funds, or public shareholders. The intended split separates Origins LNG assets from the electricity generation and retail operations.

My electric bill (due today) is $520. thats after all the rebates etc I get for being a low income person/pensioner. Havent had one like that for the longest time. I’ll just be on short rations for this fortnight (being that insurances are also due, house and contents having been boosted, too)

It will be interesting to see how this goes. Will the market prevail? Is there always a reason to continuously raise prices? Many questions with some answers coming as the ‘increase cycles’ are coming up.

l installed a 6.6Kw system, 475w panels, in late feb. Signed up with Powershop for the 13c FIT and am now $240 in credit. Have the Evo heat running 2 hrs in the morning, 1 hr from midday and from 3-4pm to maximise solar usage (l got a 150lt system and in hindsight should have got the 270)

Can we assume that is the credit for solar export (feed in) independent of the cost of any consumption and daily connection charges?

Note:

Our 5.5kW system typically exports 600-1100kWh every quarter. Varies with season/time of year. Worth up to $132 at 12c FIT which just covers the daily connection fee. Any consumption is a net cost. YMMV.

lt’s my account balance…will see how it goes through the winter months, my system is generating about 1Kw less already (and l have a gas heater)

That’s amazing.

Checking on line (Energy Made Easy) with Powershop the best deal I can get would have cost me $200 for 3 months for Spring Summer when solar PV is at its best. 566kWh purchased, 1111kWh exported, 90 days connection charges, approx 700kWh self consumption.

Powershop only offered 3.5c FIT. We are in SE Qls, so plenty of summer sunshine. If it was 13c FIT which is exceptional, it would reduce the estimated bill by 9.5c x 1111 = $105.55.

IE still an estimated bill of $94.45 for the quarter.

It remains amazing to hear your solar system is in credit by so much.

For comparisons with Powershop.

Alinta, Simply Energy, and Sumo all came back with plans estimated at $150 billed cost. If they were offering 14c FIT, perhaps they would be near to zero cost.

Past experience with using the Apps provided by Origin and AGL is the way they reported progressive billing was misleading. They reported the export credit prominently without deducting the accrued cost of any useage, the daily consumption charges, etc. I learnt that when what was supposedly a credit turned into a bill to be paid when issued.

Yes, l do wonder if l’m “reading” it correctly. They’re monthly statement is light on info (unlike the ones l was getting from Red Energy) as is their online portal & app…there is no actual balance to be seen on the webpage re credit/money owing, the app shows a balance which l have to assume is correct and up to date. That said, l initially set up auto dirct debit and haven’t had any payments from my account.

Edit - l just checked my account, l bought $70 worth of power when l got the 1st statement not knowing how much l was generating vs using, so l’m really $170 in actual credit…l live on my own and dont use much electrickery, have all led lights, powerboards with master outlets etc and cook largely in an airfryer

Perhaps the next bill will more fully explain. We’ve been receiving credits from the state government through the latest round of government subsidies against increased electricity costs.

They also create a credit on the costs to date, but are not fully evident until the bill is issued. We get our bill emailed quarterly. It looks just like the old paper bill.

P.S.

Note on knowing your solar generation, Solar PV systems usually come with a free App and cloud or local network connection to monitor the system performance. Not all installers take the time to explain or set up the connection. Brands may also require a local connection to the internet as a condition of the extended inverter warranty.

Yep, l have the app for the inverter

Some of the farcical nature of privatisation is revealed.

and specifically that

to better reflect the costs of retailing electricity," the AER said.

The costs of retailing have ‘allowed a slightly higher’ increase? If there are 20 competing companies all selling electricity from the same generators through the same networks they reasonably have replicated the billing, management, and customer service systems 20 times over either directly or by outsourcing. How and how well they negotiate their own inputs and their profit margins and ‘maximisation of shareholder value’ are variables.

Too many retailers with too many mouths to feed, CEOs, Boards, Staff, upkeep of buildings and other replicated equipment and personnel. Efficient? No way and yet the Energy Regulator says the retailers need to recover their costs…it beggars belief that consumers have to support that elephant in the room.

Cut a few retailers or even better make it a public entity again and get rid of the private industry that just increases costs and decreases the efficiency.

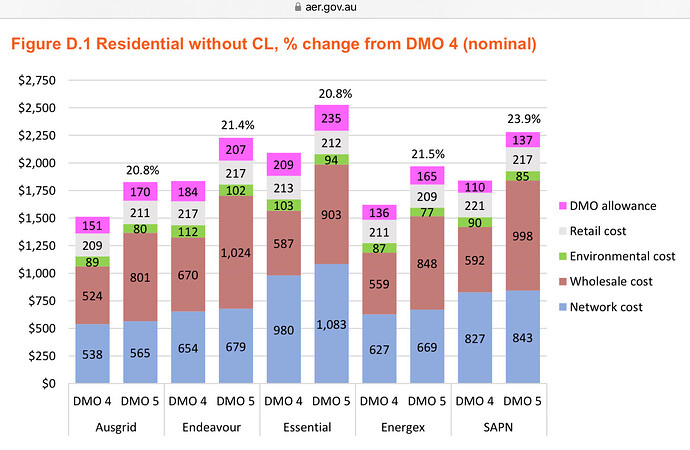

There’s no joy in what the AER has determined for those on the Default Market Offer (DMO) in SA, NSW and SE Qld.

A link to the two page info graphic. Apologies it’s not readily legible if I paste it as a graphic in this post.

What’s changed? In the following graphic for the average customer on a flat tariff DMO 5 is how it works out from 01 July 2023, while DMO 4 is how it is now. A direct comparison between distributors is not possible as the annual consumption assumed differs for each region/distributor. It should be self evident from the chart which cost components have increased the most and by how much.

The graphic assumes residential customers with Ausgrid purchase 3911 kWh annually, Endeavour 4913 kWh, Essential Energy 4613 kWh, Energex 4613 kWh, SA Power Networks 4011 kWh.

There’s further details and alternate graphics for those customers on controlled loads, as well as small business customers in the source document.

The determination is most relevant to the approx 5.5 million residential customers or 0.5 million small business customers the AER determination covers. The majority of these consumers are on negotiated price contracts which are supposedly better offers.

Consumers in regional QLD, Vic, ACT and Tas despite being part of the NEM will need to look to their state/territory regulators for how their costs will increase.

Consumers in WA and the NT where there are very different arrangements will also need look to their governments and news reports for the latest.

Hi

I’ve just had notification of “important changes to my AGL energy rates”, and no, they’re not being reduced. The usage rate is going up from ~20 c/kwh to ~28 c/kwh and supply charge is increasing by ~10%.

I’m tossing up whether to switch retailers as I think it likely they’re all going to do just that. Is this where market competition is good for the consumer? When exactly does that kick in?

Thoughts?

Hi @bronwastaken,

I moved your post about AGL into this existing topic highlighting the overall increases we all face.

Depending on your state if you in the east, use energymadeeasy.gov.au for Qld, NSW, ACT, SA, and TAS or compare.energy.vic.gov.au in Vic. Each state has its own ‘kick-in dates’ and other rules, such as Victorian retailers can normally only change prices once per 12 months (although there are exception) but when that is is not stipulated and it need not be spaced out.

AGL is rarely the best deal but in some places it might be. Shopping around each time you receive a price rise is the smart thing to do, but as you imply one has to be wary when the ‘other’ retailer might change their also. There are very few (any?) fixed rate over the term of the contract that look competitive these days.

OTOH there are no longer costs to switch so each time an increase is put on the table one can contact the existing retailer to see if they can do better, if not ask for their ‘customer retention department’ as some have one that can do better than standard (although some retailers do not), and importantly get competitive quotes from the appropriate one of those two government comparison sites.

Sites such as comparethemarket and iselect are owned and operated by ‘the industry’ and only compare their own products and should be avoided as being incomplete marketing exercises although they do provide educational data points.

The advice (email and letter) we received from AGL was in advance of the changes for our location. It nominated the change date. The commencement date 01July23 appears to be common across all retailers for our network. As @PhilT mentioned the dates increases become effective vary according to state/territory/distribution network.

One caution with the Energy Made Easy web site or any other price comparison web site/resource. They typically use the current rates. If a rate change has been announced but is from a future date - my experience is the comparisons use the old rates. Proof in our instance was searching Energy Made Easy for the best deal. The best pricing was not AGL. When I restricted the offers to AGL only:

None of the offers were the same as or as costly as the new rates AGL advised,

The plan listed in AGL’s written notice and cost increases returned significantly cheaper rates than the letter.

The plan to which we were currently signed was showing the current plan lower rates.

Since it’s now after 01July23 I can now look for a better deal. In the interim AGL or any other provider will be crying all the way to their profit announcement. I’ve not the patience to ring around all the likely prospects, wait on hold, wait to get onto the right rep, and not say yes, because there’s umpteen more plans and retailers to assess. Energy Made NOT SO EASY!

P.S.

One of the ‘extended’ approached AGL and came away with a different plan apparently with a lesser increase. Not so sure how it stood up to other retailer offers. Some of us oldies with low consumption are less keen to change from what we know.