An article claiming that electricity prices will decrease.

Looking at SE Qld and AGL and Origin it may already be on the way down compared to 12 months previous.

As an example:

Origin has reduced the daily supply and metering on its Solar Savers plan from $1.3099 daily to $1.2303. (8c pd rounded reduction). Consumption tariff 11 has dropped from 25.56c to 24.91c per unit. (0.65c or approx 2.5% saving). Solar feedin though has also dropped from 17c to 15c. There are other Origin products with lower daily and consumption/usage tariffs, but only 7c for Solar feedin.

For anyone with Solar plans with AGL the best feed in tariff offers have decreased from 20c to 17c. It’s a bit of a mix and match regardless of which retailer you go to. If you are a large net exporter the best retailer and plan offer is likely the one with the highest feedin tariff.

It would be great to pull all the alternate offers apart simply and conveniently. I’ve tried and just noted:

The Federal Govt Aust Energy Regulator - EnergyMadeEasy web calculator is next to useless as it does not factor in solar feedin credits.

Not here in the Deep North where consumers are stuck with Ergon’s monopoly rip-off rates.

Tarrif 11. 26.027 cents/kwh. FIT 0.7842 cents/kwh

![]()

We both know I’ve lived in the deep north too!

The catch here is between social equity where electricity is supplied at the same price whereever you live in Australia,

And

The user pays, which in a commercially driven market allows users in the more expensive to supply north to be charged more. Of course establishing the real cost of supply to the far north remains an elusive goal.

We also have national competition policy, imposed by the Federal Govt long ago, with one desire. To dismantle state run enterprise in favour of private ownership. Whether in the end the other stated outcome of lower costs to consumers delivered through privatisation has come about remains highly contentious. Except for those invested in the private ownership?

Observing how the not quite ready for sale NBN project has treated us all equally (NOT) and delivered or not cheaper internet, perhaps the Deep North may be better of as is with Ergon for electricity the time being.

P.S.

The downward trend in solar feedin tariffs may see all equal in the near future. Although those in the larger markets around Sydney, Melb, Bris may in the future see competition for customers deliver them the best deals.

My calculations for the previous 10 months show that we paid over $250 more than the figures you quoted for SEQ.

And of cousre, Ergon owns the “poles and wires” whereas the SEQ resellers have to pay Energex for them.

As far as the NBN goes, we are receiving a much superior service at a lower cost than we were with ADSL2+, both with Internode.

So if our experience with the NBN is anything to go by, then bring on competition to Ergon tomorrow.

I’d offer up the current offers from AGL and others, all of which beat a origin for Solar. Another 25-50c pd lower costs on average usage with solar. Yes, there is a big gap for electricity charges between the North and South of Qld. State election in Nov if that is likely to make any difference. ![]()

Actually 31.10.2020.

I won’t hold my breath.

A couple of articles that could readily have gone on the Climate Change thread. There will no doubt be impacts on electricity prices as well, so this is a better place:

Speculation of a more positive kind through increasing demands for charging of EV’s.

In the next few years the prospects of more grid connected storage may be tempered by a lack of return. The following considers the opportunity battery powered vehicles to take up low cost solar PV sourced energy from the grid during the day and feed it back in at peak times helping to flatten the power demand cycle. This could benefit both the transport and electrical power generation sectors for a single investment in more BEV’s.

ARE WE THERE YET?

The one caveat might be at what premium would the power be purchased back from the consumer? It would need to be at a premium to the value lost from the average expired life of the vehicle battery in each transaction. The battery cost estimates from the SolarQuotes website put a Powerwall 2 at 31c per kWh (lifetime cost). Hopefully a BEV battery is less expensive over time!

For a BEV charged from PV at home with an option to sell back from your BEV at night, it might need close to 40c/kWh as a minimum feedin tariff to cover the cost of the loss of battery life? Or you might expect equivalent savings in kind from your retailer. This high tariff may stack up for the retailers/generators against the cost of investing in more peak power capacity and operation on gas? Updated note to clarify intent.

Note

(Tesla claims a minimum 1500 cycles from a Model 3 battery - 52kWh nominal standard battery. This would give approx 75,000KWh before any lifetime degradation losses.) Elon’s boast of a US$5,000-$7,000 for a replacement battery module seem too good to be true. That’s AU$7,500-$10,500. I guess any day soon the Powerwall will get an upgrade to 52kWh and still only cost AU$15,000 fully installed.

The current standard feed in tarrffs are significantly less than that…

| State | Current Rate Paid* |

|---|---|

| VIC | 9.9 to 29c/kWh (depending on retailer) |

| SA | 11 to 16.3c/kWh (depending on retailer) |

| ACT | 6 to 12c/kWh (depending on retailer) |

| TAS | 8.9c/kWh |

| NT | Same as consumption rate / grid purchase rate |

| WA | Varies*** e.g. 7.1c/kWh (Synergy) |

| QLD | 6 to 12c/kWh (depending on retailer) |

| NSW | 11.9 to 15.0 c/kWh (depending on retailer) |

Source: Australian Solar Feed in Tariffs Information | Energy Matters

The feed in rates (excluding NT) are based on the energy component and does not include network costs or other charges. The NT system is a new based system were exports are in effect traded against/offset imports.

One of the reasons that state governments dropped the bonus rates to the energy only rates was because those without solar were subsidising through higher energy costs those with solar. The greatest impact being on low income earners and renters, which often can’t afford/absorb increases in essential products and services.

Obviously it is not just the feed-in tariffs, it is the game where high feed-in tariffs most often are associated with much higher, sometimes obscenely higher, charges for what is taken from the grid. Without the two being considered together it is a game rather than meaningful data.

True only for the ‘Everyday Home’ tariff (flat) - on the ‘Switch to Six’ (split) tariff the rate for export is the flat tariff rate, not either of the split rates.

NT hasn’t had prices like that in years? https://www.jacanaenergy.com.au/residential/pricing

My understanding is NT has a net feed in tariff - my meter registers only the export not what I use on site? thats how the figures work when I compare the meter readings to my inverter readings. No complaints here though, no power bills and $500 per year in credit ![]()

I wouldn’t pay too much attention to what is on the EM pages these days, as I suspect none of it has been kept up to date for well over a year.

I’m in NSW, and am paid only 10.2c/kWh ( PowerShop )

Apologies, I wasn’t aware that EM is no longer maintained. Solar Quotes has links for quick reference…and may be better one to review…

Wow, in Qld I currently get 20c/kWh with AGL. It is however not that simple as it is also important to consider the daily connection and metering costs as well as cost of purchased power.

As a point of interest. How much ability do consumers genuinely have to influence the market for electricity?

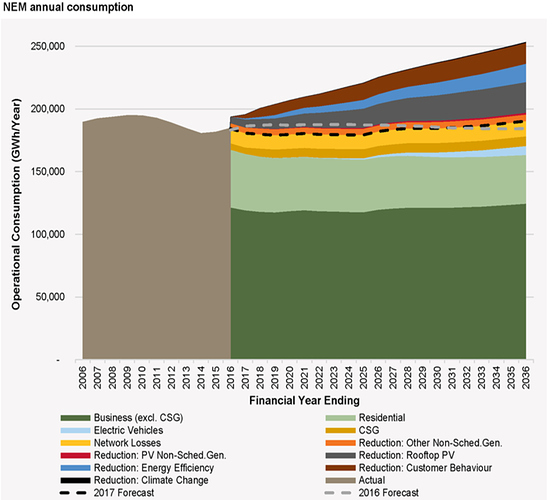

Australia in the NEM (National Energy Market) which excludes WA and the NT consumes approx 200TWh (terra Watt hrs) of energy each year.

But, (it’s a very big “but”), consumers are responsible for only one quarter or approx 25% of consumption.

From the AEMO, apologies for the slightly dated overview.

https://aemo.com.au/en/energy-systems/electricity/national-electricity-market-nem/nem-forecasting-and-planning/forecasting-and-planning-data/nem-electricity-demand-forecasts/2017-electricity-forecasting-insights/summary-forecasts/annual-consumption-overview

It is self evident from the graph who the other big user is and who purchases or pays for the rest.

The ongoing uptake in residential roof top solar is great. But (the big “but” again) it is open to challenge that consumers need to invest in ‘fair dinkum reliable power” to save household electrical supply?

The greatest need for securing the network and power supply is to meet the needs of business and industry? True, that is all to do with having employment, but not to do with forgetting to turn the lights off at home.

P.s.

For current actual consumption (residential use not detailed)

I do wonder why government and industry talk has a focus on the consumer and residential consumption when some of the greatest opportunities for change lie elsewhere.

An article regarding Australia’s LNG industry and the effect on electricity prices.

Other countries must be laughing at Australia being the world’s largest LNG exporter whilst planning to import it.

Correction?

Australia is not planning to import LNG.

The possibility is on paper only.

A consortium involving billionaire mining magnate Andrew Forrest and Japanese investors has approval to build a gas import terminal at Port Kembla which could supply 75 per cent of NSW demand.

Bizarre or not Australian gas exporters entered into long term contacts to sell Aussie gas as LNG overseas. These contracts have protected the foreign investments from falls in the spot price for gas due to an oversupply in international markets.

If the terminal is constructed the owners will be able to import low cost gas on the OS spot market, and offer it up at the higher Aussie market price making a tidy profit on current market prices.

The real issue is government/s have allowed exporters to enter into contracts for volumes greater than they can supply, unless they …?

Gas previously able to be supplied to domestic markets is being exported!

The higher domestic prices have cost Australia jobs through the higher cost of domestic gas supplies!

Oh, and pushed up the cost of peak demand electricity supply.

A lot of the things that Australian governments, politicians, were told when those projects went ahead, turned out not to be true," Australian Competition and Consumer Commission (ACCC) chairman Rod Sims told ABC News

And to those furphies you can add the often repeated claim that if States on the east coast suddenly start approving more greenfields gas projects that it will magically fix high price of domestic gas.

As for these supposed gas importing terminals, I wonder if any of them will actually get built. The industry makes a habit of spruiking the benefits of projects still on paper as if they were real.

As I have said several times before (so I will not repeat the detail) the gas cartel and APPEA only care about one thing; utilising the gas export market to maximise their profits and that includes enjoying the windfall from the domestic price rise.

And speaking of furphies, have you heard the one about gas as a ‘transition fuel’? Has anybody notice the articles here, here and here about the systemic underestimating of the effect of fugitive emissions of the powerful GHG methane?

Power companies will no longer be able to charge their late payment scam charges.

Pity it won’t start until 01.7.2020. Should be retrospective to 01.07.2010.