I’m not convinced Uber drivers, their vehicles and the Uber Business are exempt from application of the legislation, in some way?

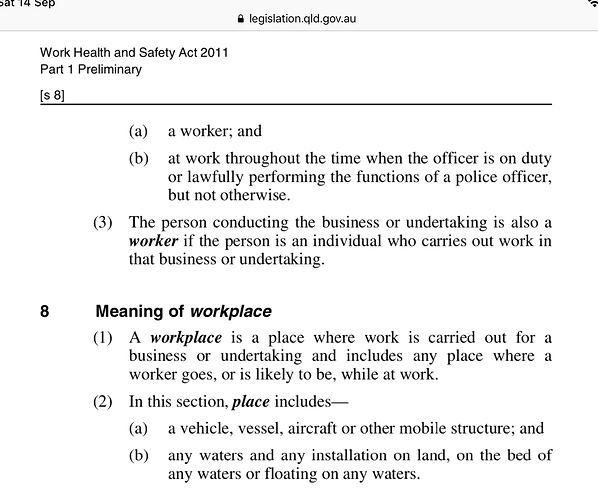

S8 - (2)(a) seems to say a ‘vehicle’ is a workplace.

In one context the question asked is rhetorical.

Ultimately each state government and the legal profession will decide if needed.

I prefer the legislation as a primary reference. For Qld it is very broad in what it covers. The legislation is not restricted or specific to construction. Even the activities of volunteer organisations are captured.

https://www.legislation.qld.gov.au/view/pdf/inforce/current/act-2011-018

P.S.

It seems to apply to the taxi industry! Should Uber be any different?

The Gig economy might appeal as being totally free and open?

Reality asks,

Are organisations such as Google, Amazon, Uber, etc any different to totalitarian states?

They largely make their own rules for inclusion, while exclusion is absolute.