Hi there, CHOICE investigative journalist Jarni here. I’m working on a story on Buy Now Pay Later and mobile payday lending apps. Have you used Buy Now Pay Later (Afterpay, Zippay ect.) or taken out a payday loan through a mobile lending app? Have you subsequently struggled financially to make repayments? I would love to chat with you about your experience. Get in touch - jblakkarly@choice.com.au

Hiya @jblakkarly, I occasionally use AfterPay or Zip pay to purchase items that are on an amazing special price for a short time. After one has used AfterPay for a certain number of purchases one can buy something without having to pay anything up front, as long as they repay the business a certain amount of money each week. I have found this most useful between Paydays when an item comes up on Special and it is something that I really need (or want).

I have never paid interest on this Scheme, and have enjoyed the fact that I can split my payments into four separate amounts to be repaid each week.

I am also very aware of how much I am spending on these Deals, in order that I do not ever over-commit myself.

It has worked really well to my advantage so far, but I can certainly see the pitfalls for those who may over-indulge purchasing items that they do not really need nor can afford.

Hi there, I would love to have a chat to you about your experience. Are you able to drop me an email to jblakkarly@choice.com.au ? Thanks

I mostly use ZipPay. or AfterPay for paying over time for purchases and treat it like a layby purchase (many places have dropped layby in favour of these types of services). The $6 monthly charge by Zip.co can be a catch, if you buy at the beginning of the month and pay it off before the end of the month (actual month ie May) you don’t get charged. However if any month boundary is passed eg you buy on the 31st of May and finish paying in June you may pay the $6 fee for having an outstanding balance at the end of May. They say you won’t as they will waive the fee but it often gets tacked on regardless (ZipMoney) “If your balance is paid down before the end of the month, the monthly account service fee is waived.” & ZipPay " For example: If you make two purchases in February, on the 1st of March, we will send you a statement showing your owing balance. You’ll then have until March 31st to pay the balance off without being charged the $6 account service fee."

AfterPay because you don’t really have a limit and the most you are going to pay on any transaction is 25%, if you buy lots of things at multiple locations and/or expensive things you can rack up a total where you are paying a huge amount each payment to AfterPay (or you default and get extra charges for the default). So if using AfterPay I always only buy with that and that one thing and make no other purchases with Zip or AfterPay until the payments have been completed.

Zip have limits (after steady and on time payments you can often be offered a increase to the limit). So with Zip you can at least know you have hit your set limit. Zip does not set a timeframe for how long it takes you to pay it off by, but each month there will be $6 tacked on and they do set minimum payment amounts based on your limit not on what your purchase value…from Zip site…For ZipPay it is " You can change the frequency of your payments to weekly, fortnightly or monthly, as long as you pay minimum $40 per month (or $80 if your credit limit is $1500). Choose what works best for you!". For ZipMoney it is slightly different “Repayments start from just $40 a month and are determined by your account’s credit limit - the higher the limit, the higher the minimum monthly repayment.”.

Using Zip’s services and AfterPay at the same time is often a recipe for disaster budget wise.

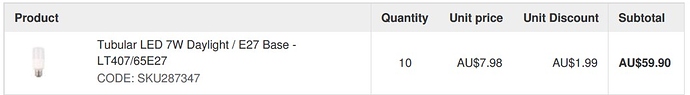

Another catch is that many places will add a surcharge for using these payoff schemes. As an example:

“• zipMoney - 2% transaction Fee

• Afterpay - No Fees”

The price of goods in a Store that use one of these systems have often increased all prices by the amount of % fee they have been charged by the Scheme/s they use I think it is about 4% for AfterPay linked Stores but it is hard to actually quantify because pricing structure is opaque. So no matter whether you use AfterPay or not to do a purchase you pay that extra on every item.

I would assume it is similar for Zip and other schemes.

AfterPay I believe contract with a Store that they are not to surcharge purchasers but that is not strictly supervised by AfterPay to ensure no surcharge occurred if they only see a total. I’m not sure of what other schemes require of the affliated stores. Building in the cost of the schemes is the easiest way to bypass any contract arrangement about not surcharging on purchases.

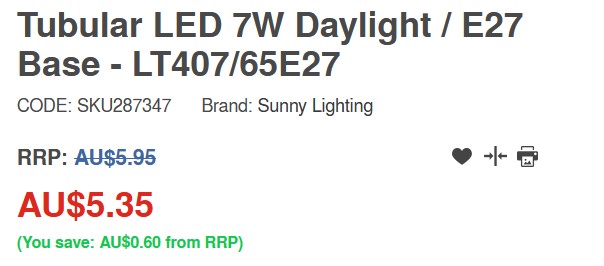

An invoice cost and a price listing that seems to support the added markup (even with the discount applied it is still at least 2 cents above the RRP. It is worse when you consider the original invoice price before the $1.99 deduction is substantially above RRP.

12 months earlier the price was far cheaper

At least now the entire house is LED lit rather then CCFL.

Hi there, I would love to have the chance to speak to you further about your experiences using Buy Now Pay Later services. Would you be able to drop me an email at jblakkarly@choice.com.au ? Thanks. Jarni

Dropped an email to you so you have my email address.

A bit of clarity would assist in looking for the true villains. For example the claim that 1 in 5 BNPL users has had to do without to meet a payment is simply not true for example for Afterpay or Zippay the two biggest BNPL providers. These companies are merely recreating the old Lay By system with the exception that you get your item upfront.

If you read their financial reports you find that the default rate is around 2% or less. The villains, apart from the banks which are the very worst and most immoral credit card providers with the biggest punitive interest rates for those who get behind are the companies that provide credit card to every Interest free customer at the big domestic chains.

These companies rely on people defaulting on their failure to meet the necessary repayments on time as once that happens the interst free become interest punitive.

In addition the limit for Afterpay starts in the low hundreds as does Zip and maxs out at between $1,000 and $1500.

I now use my Zip app as my default card which I pay once I reach my limit. I also find that because these two companies have such a big reach at retail level that there are frequent offers of money back promotions e.g. I recently acored $20 rebate for buying items at Target and last Chrismas period 3% rebate from ZIP on all my purchases plus a $10 money back for any and all retailers for selected days during the period. It more than covered any $6 fees which by the way have rarely applied.

If you check reviews of both ZIP and Afterpay and some of the others the main complaint is that they have been denied credit n the first place although I hear Afterpay don’t even check for the first purchase.

The more we can do to reduce reliance on high interest credit cards the better off we will all be.

Welcome @smithy777

The old layby systems often had a small service payment, a deposit often at the beginning but if you failed to pay your goods off often any payments less the service fee were repaid. There was no charge if a payment was not on time, and often laybys could be extended by contacting the business with no extra charge for taking longer to pay it off. This does not occur with AfterPay or Zip, a default does cost money, the charge a business loses from their sale to the credit provider is often factored into increased prices of the goods sold.

Not everyone who uses AfterPay is quite so money savvy as well and often with the no real limit structure they can accrue a great deal of Debt that only comes home to roost when payment is required. Zip at least puts a limit on total expense.

I am a happy user of the Buy Now Pay Later schemes and enjoy the largely interest free nature (I think the price rises are a hidden interest charge of using them though) but I’m also aware there are other costs and pitfalls that remain hidden or foggy.

I heartily agree with your take on Credit Card interest rates, which I think are obscene.

Choice calls out Buy Now Pay Later schemes.

There is apparently big money and much slight of hand. Another participant - Suncorp w/Visa.

Here’s Jarni’s story on the big banks entering the BNPL market. Thanks for the comments everyone!

An article regarding the BNPL debt traps.

Has anyone else been having problems with Citibank’s mew BNPL facility, Spot? It’s basically not been accepted at retailers around Australia since early November. They’re claiming technical issues but it’s really fishy. Whatever you do don’t apply for this product, it simply doesn’t work.

Welcome to the Community @Nick956

Thank you for your post on this BNPL scheme. I have moved your post into this already existing topic on CHOICE’s delve into reporting on this burgeoning financial industry product. There are so many now it becomes ever more difficult to understand which you may want to use or even if you want to use one or many and the very real risks that can occur from using them. You may be interested in reading the prior posts on this type of product.

Thank you again for your post on this matter.

Thank you, really appreciate it!