There is also economies of scale. The more widgets made, usually the lower the unit manufacturing cost and willingness to reduce profit margins.

It is not just manufacturing that has declined in Australia to be replaced offshore. It is also services. The economic principle of comparative advantage is just as strong in both areas. With the advent of high-speed data communications came outsourcing and then offshoring in the IT support area, and in “cloud” computing.

But that is a bit straying off topic.

I think that what can happen if a society offshores its basic needs can be seen in Venezuela today. Vast amounts of oil revenue. Government decrees that everything we need can just be imported using the oil export revenues. Local ability to produce things declines. Then the oil price crashes.

A thinking person might wonder why the worlds largest producer of lithium does little more than export concentrate.

I found the following from Austrade and the Govt. A brief thought the minister credited Simon Birmingham was super keen on lithium batteries as part of Australia’s future.

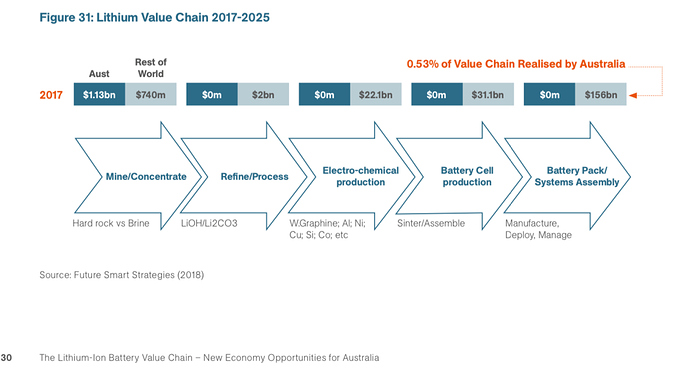

The value chain is represented in the following chart. It is a year or two old.

From global production of lithium batteries just 0.5% of the final value is earned in Australia. It’s difficult to say it is also earned by Australia (IE value kept in the country) without pulling apart the ownership of each Miner and producer of lithium in Oz.

The global industry was worth more than $213 billions in 2017. Relevant to another topic is the prominent role of China in the key processing stages of production after mining.

The opportunities clearly exist!

The USA’s and world no 1 battery fan (Elon Musk) is looking to invest in nickel mining/production in Indonesia along with another battery factory.

Not that Australia is into batteries?

Cynically or tearfully, we must just be plain lucky to have the gas lead recovery, popularity assured?

P.S.

Should Australia stick to what it’s best at? Buying stuff on line from Amazon and Alibaba

Interesting question, and not one with a simple answer.

Much of the problem comes down to money. Beyond human imagination, money doesn’t exist, yet we obsess over it. From the perspective of a nation with a sovereign fiat currency, if we imagine that we don’t have enough money, then we can simply imagine more. Some will panic about inflation but, in an economy with spare capacity, increasing the money supply doesn’t cause inflation.

So does Australia have spare capacity? The answer lies in what we waste. Underemployment has been trending upward for at least forty years.

If we can afford to waste so much labour, then we have spare capacity.

We have thousands of times as much energy available to us as we use. So we have spare capacity.

In short, if anyone can show me an economic sector where Australia doesn’t have spare capacity, then I’d be interested to see it. So why do we allow so much waste?

I reckon it comes down to fear and self-interest. The self-absorbed fear that they’ll be worse off, so they resist change. Positives of living in a stronger, fairer society and a more robust, more resilient economy are invisible to that mindset.

The COVID-19 pandemic exposed our fragile supply lines. China’s belligerence reveals our dependence on too few markets and sources of supply. Those are weaknesses that effective management could overcome. All it would take is leadership with the intellectual capacity, the ideological will and the courage to manage our resources.

Unemployment keeps a lid on wage demands, which maintains corporate returns on investment, which (in the short term) makes owners richer. You say unemployment has been rising for 40 years. Rather than a steady rise there was a big jump in the middle 70s and the graph has wiggled along up here and down there ever since. This was due to policy. Both sides of politics now have a policy of maintaining around 4-5% unemployed whereas in the post-war era of “full employment” it was more like 1-2% and most of those were short term stints between jobs.

We now have a permanent underclass of long term unemployed. When reality catches up with dogma and our leaders accept that keeping wage growth too low puts a big damper on growth - and almighty growth has to be maintained at all costs - we may see some change. It won’t be because keeping a reserve of poverty is doing wrong by a slice of society, it will be because we are here to feed the machine not that it is here to feed us.

An article about the RBA expecting weak wages growth to impede economic recovery.

Perhaps Government and business may be shooting themselves in the foot?

Which is pretty mad, IMO, its just not possible to continue growing infinitely… taht will kill the planet as surely as climate change.

No.

One hour per week of paid work is classed as “employed”. “Unemployment” therefore doesn’t measure anything meaningful.

There are many things, local manufacture of which would benefit the nation, though it might not be as cheap as importing. ![]() Maybe privatising CSL wasn’t such a good idea.

Maybe privatising CSL wasn’t such a good idea.

And another domino falls:

The problem, it seems, is mindless Totalitarian Capitalism. We wilfully ignore all costs except those that can be expressed in dollars.

Economies of scale play a part. Singapore has just 3 refineries processing 221 million litres per day between them. Altona currently processes just 12 million litres.

Refineries have an economic life of 30-40 years. Assuming Altona has reached it’s end, funding new investment for a carbon based technology might not be so easy these days. Stranded asset, noting Australia now derives more of it’s energy from oil (petroleum products than coal). Globally even Shell has set a course for carbon neutrality by 2050.

Perhaps Exon can read the writing on the wall, with Ford and GM committing to a future producing EVs only by 2035, and key EU nations banning ICE vehicle sales from as early as 2030.

Curiously many of the skills acquired in operating and maintaining an oil refinery are transferable into new technology processes used for refining or producing battery materials. Or alternately for producing fuels and fertilisers from electrolysed hydrogen.

I worked for Mobil years ago. Even back in the 1990s there were determinations every few years on whether to shut down Altona refinery or spend a lot of money on keeping the creaking old fossil going. They shut down the SA Port Stanvac refinery in 2003.

I am amazed that Altona refinery has lasted this long.

So little crude oil is produced in Australia these days anyway it doesn’t make a lot of sense to refine it here when the refined product can made and shipped here from mega refineries in places like Singapore, the US or the middle east.

Without arguing economics, the concept of national [energy] security falls into the discussion bin with F35 fighters, submarines, and similar uneconomic overpriced ‘items’.

It could be in the bin with things that cost but they still have immeasurable value. Imagine Australia virtually shutting down completely because of even a comparatively minor international situation. Could Altona pick up or supply that slack on its own? I don’t pretend it could but when just in time scheduling and just enough inventory rules the day it is almost an invitation for a problem sooner or later. At least until the energy source is essentially replaced in a practical sense, for most everything.

Here in Newcastle, there was a healthy ship building industry, and train manufacturing, but the contracts always went someplace else. There was a big dry dock too, but the government sold that off. The capacity to manufacture our own ships, and trains is still here. The skills are still here… but the contracts go elsewhere. Can’t help wondering what gets passed under the table.

That is the crux of the matter.

There would be little difference in depending on tankers arriving with crude oil to tankers arriving with refined fuel.

Both would be subject to the same problems if an incident occurs.

Straying from the topic.

If the closure of Altona was strategically a risk, it’s so out of character for our leadership to let that one pass. If it at all ranks with F35’s and new submarines by 2050. Certainly investment in a new oil refinery or coal fired power station are loose change in comparison.

Australia’s remaining oil refineries have substantial capacity, relative to Australia’s capacity to produce crude while reserves are also insignificant. Most of these are located in the NW shelf off remote WA.

Australia, even if it had refinery capacity to produce 100% of it’s total needs would need to source 90+% of the feed stock from the same geopolitical regions our current imported refined product is sourced from. IE SE Asia and the Middle East.

Back on topic.

In respect of manufacturing the opportunities to reinvest in the replacement technologies (even strategically) are in transitioning the resources to hand. For military and other needs (health, education) funding is always found (if not as much as we would all like). The premiums paid might be grumbled about. They are accepted as part of the costs of progressing Australia.

Transitioning industry/manufacturing exists in a different Econo-sphere. One where a cultivated fear of the consumer wallet and the premium for the new technology should be rejected least we all need to pay more for electricity and our transport. The contradictory stance and market uncertainty is IMO and that of others why jobs will continue to be lost, rather than new opportunities in manufacturing/industrial processes gained.

Which leads me to ask: why is the refining here essential to fuel security if crude is not produced here?

For local refining to provide refined fuels during a shipping crisis which prevents import of those fuels there must be substantial stockpiles of imported crude or the import of crude is not interrupted.

If the crisis scenario assume that import of refined product can be blocked but import of crude cannot, the refineries can be kept operating. Why would that be so, are we assuming certain shipping lanes are impervious to interference, if so what evidence is there for that?

OTOH if the refineries will continue through the crisis using stockpiled crude why can we not stockpile refined product instead and do away with the refineries?

Can anybody explain this to me?

Refining isn’t essential, unless Australia produces the crude to feed the refineries. Indicating it is important is one of the political furphies associated with current ‘fuel’ security discussions.

The political argument is that if we don’t refine oil, we are reliant on refineries in other countries producing petroleum products for us. These other countries in times of hostility have the potential to restrict Australia’s supply of such products when ever they chose, causing enormous economic damage to Australia. It is worth noting that Singapore, Japan and South Korea provide almost all of Australia’s refined oil products and these countries are developed and considered allies of Australia. The risk of these countries restricting supply is low.

What is not recognised is that we import about 83% (and is increasing year on year) of the crude oil used in Australian refineries. Many of the countries Australia imports crude from are developing countries or have a geopolitical environment very different to Australia. The risk of supply disruption from these countries is significantly higher than the countries which refine.

Australia’s current fuel security doesn’t lie with import of refined oil products, but the import of crude oil from these other nations.

The only downside of importing refined oil products over crude oil is if there is a dispute between the crude producing countries and the refining countries, Australia could be directly impacted by any dispute even if the relationship between the crude producing countries and Australia is not in dispute.

The only way for Australia to really have true fuel security is for the government to encourage exploration and development of oil reserves in Australia and its waters, and other territories it has control over. In conjunction with this, existing refineries would need to be mandated to process Australian sourced crude oil as a priority (over imported crude oil). The community also needs to support the development and expansion of Australia’s existing small scale crude industry for Australia to have a higher level of fuel security. I suspect in the current political environment within Australia, a government policy of such nature wouldn’t be palatable.

Australia is considered delinquent in its storage reserves of refined fuels. The recommended amount is 90 days normal use for member states of the International Energy Agency and Australia is about half that.

The Federal Government fails once again.

That says to me that local refining is not central but part of a broader potential problem.

That is assuming that there are substantial oil reserves in those areas that are cost effective to extract. We don’t see oil companies wanting to explore for oil there (unlike gas) so that seems unlikely.

If it is going to take government encouragement to reach security perhaps a better choice is to encourage quitting reliance on oil sooner rather than later.